Τον Απρίλιο θα κυκλοφορήσουν τα νέα “έξυπνα” έπιπλα της ΙΚΕΑ που θα φέρουν επανάσταση! | Τι λες τώρα;

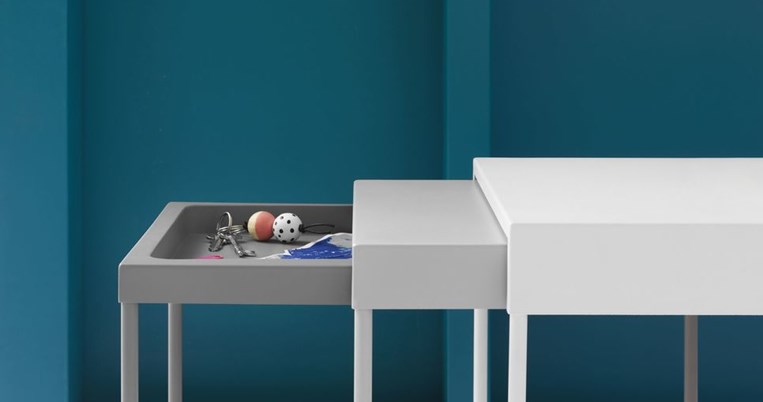

Έξυπνη αγορά: Το έπιπλο πολλαπλών χρήσεων της IKEA που κάνει θραύση -Με μοντέρνο design, μπαίνει σε κάθε δωμάτιο | BOVARY

Τα δύο έξυπνα έπιπλα από την ΙΚΕΑ που θα εξοικονομήσουν χώρο στο μπάνιο και την κουζίνα σου - iefimerida.gr

![Τα νέα «έξυπνα» έπιπλα της ΙΚΕΑ – Θα κάνουν επανάσταση [εικόνες] - iefimerida.gr Τα νέα «έξυπνα» έπιπλα της ΙΚΕΑ – Θα κάνουν επανάσταση [εικόνες] - iefimerida.gr](https://www.iefimerida.gr/sites/default/files/styles/in_article/public/2015-03/ikea255_0.jpg?itok=waExSPgQ)

![Τα νέα «έξυπνα» έπιπλα της ΙΚΕΑ – Θα κάνουν επανάσταση [εικόνες] Τα νέα «έξυπνα» έπιπλα της ΙΚΕΑ – Θα κάνουν επανάσταση [εικόνες]](https://i0.wp.com/neodimokratis.gr/wp-content/uploads/2015/03/attached_image094.jpg?w=1200)

![Τα νέα «έξυπνα» έπιπλα της ΙΚΕΑ – Θα κάνουν επανάσταση [εικόνες] Τα νέα «έξυπνα» έπιπλα της ΙΚΕΑ – Θα κάνουν επανάσταση [εικόνες]](https://i0.wp.com/neodimokratis.gr/wp-content/uploads/2015/03/attached_image110.jpg?w=1200)